Press Reset

As the final quarter of 2020 approaches, the collective behavior of markets, monetary and fiscal policy makers and disgruntled citizens of the world suggests some kind of denouement is here. Its resolution will be an infrastructure inversion whereby decentralized network-centric platforms replace centralized brick-and-mortar institutions as the foundational operating system for humanity.

The implications of this transition are vast and total. The Great Reset Initiative launched this year by the World Economic Forum frames the opportunity presented by this moment as a response to the COVID-19 pandemic:

As we enter a unique window of opportunity to shape the recovery, this initiative will offer insights to help inform all those determining the future state of global relations, the direction of national economies, the priorities of societies, the nature of business models and the management of a global commons. Drawing from the vision and vast expertise of the leaders engaged across this Forum’s communities, the Great Reset initiative has a set of dimensions to build a new social contract that honours the dignity of every human being.

The Next Seven Sisters

The best investment opportunities right now acknowledge that the world has arrived at a tipping point in the so-called “Fourth Industrial Revolution.”[1] Information in the form of data and artificial intelligence will completely transform existing dependencies on the machine technologies invented in the 19th century and enhanced in the 20th century with computing power.

The current technological evolution of the internet (Web 3.0) is inextricably linked to the Fourth Industrial Revolution and will be supported by an emerging constellation of low-earth orbit space technologies designed to transcend the legacy internet’s geographical, political and physical limitations.

The old world required petroleum products and related physical industrial infrastructure, the development, extraction and deployment of which was shaped and controlled world-wide by the “Seven Sisters” [2].

The new world requires an internet-based digital infrastructure powered by virtual commodities. While not entirely decoupled from a global matrix of physical hard assets, Web 3.0 will be a seamless matrix of interoperable global blockchains linked by next generation electromagnetic spectrum technologies (e.g., 5G and the Internet of Things) making efficient use of natural resources through advancements in green energy production.

Just as fossil fuels provided the operating power for the old world’s infrastructure, the world wide web infrastructure of the new world requires internet-native resources, also-known-as virtual commodities, tokens, digital assets and cyptocurrencies designed for specific purposes and use-cases.

One way to think about the significance of bitcoin and related technological innovations in digital assets since Bitcoin’s introduction in 2008, is to recognize that we are witnessing the emergence of material that for the first time in human history represents unique, identifiable and commodifiable units of an intangible.

Collectively, cryptographically provable digital assets are the new fossil fuels and the leading open decentralized network platforms on which they operate will be the next Seven Sisters.

We are going way beyond buying a cup of coffee with bitcoin…

2020 & The 100 Year Long

Research at my alternative asset investments firm Acre of America Partners LP is laser focused on a 100-Year Long opportunity characterized by our search for the “Next Seven Sisters.” We believe hindsight will show that 2020 was one of a handful of moments in human history granting innovators with open fields in which to plant for a multi-generational harvest. The best window of time to accumulate core positions in the free-trading digital assets that will shape our future is not behind us, but ahead - most likely October 2020 – March 2021.

The network effects, technologies and regulatory developments favoring today’s top ten projects and related digital assets must prove their resilience through the 2021 Great Reset which has been helpfully previewed by the World Economic Forum, the International Monetary Fund, the Economist Magazine and others for quite some time.

Our technical models suggest that a new multi-year low in the $BTC bitcoin price of US$1,776 is possible in a worst-case second world-wide black swan scenario (COVID-19 pandemic being the first) before retaking the 2017 all-time-high near US$20,000. We still see you Three Gorges Dam.

The 2025 Hype Train: All Aboard!

The COVID-19 pandemic has been a catalyst for increasing coordinated global action among established powers and the adoption of new values and structures upon which to remake society. Amid appeals for a new form of “stakeholder capitalism” and Omiydar Network’s call yesterday to “reimagine capitalism in America”, digital asset investing is poised for a second era of out-performance driven by the twin tailwinds of real adoption and safe haven seeking from fiat currency destruction.

We are at the beginning of an 8 year ride to the “Peak of Inflated Expectations” depicted on the Hype cycle timeline copied below. Get ready for a brief deflationary scare in Q4 2020 signaling the fueling of a rocket ship crypto moon boys and moon girls have been dreaming about (for strong hands only).

CNBC: ‘Now is not the time to worry’ about the fiscal deficit or the Fed’s balance sheet, Mnuchin says

The Release the Kraken monetary and fiscal actions of central banks and governments in 2020 are only the beginning of the final gasp of our old centralized paper system’s 12-year death rattle and signals the end of the beginning of a new decentralized digital system (i.e., the infrastructure inversion referred to above).

Contrary to what is popularly believed among crypto enthusiasts, 2017 was not the top of the Bitcoin and cryptocurrencies Hype cycle. It was not equivalent to the 2000 bursting of the Dot-Com bubble. We are still in R&D people!

2017 was 1992.

After years (decades in fact) of experimentation and innovation among computer scientists, 2017 marked the year that open decentralized peer-to-peer networks entered mainstream awareness, including among the banking, investment and government old guard. However, the user experience and access interfaces really were no more comprehensible to that mainstream than the first web browser released for Unix would have been to most people in 1992.[3]

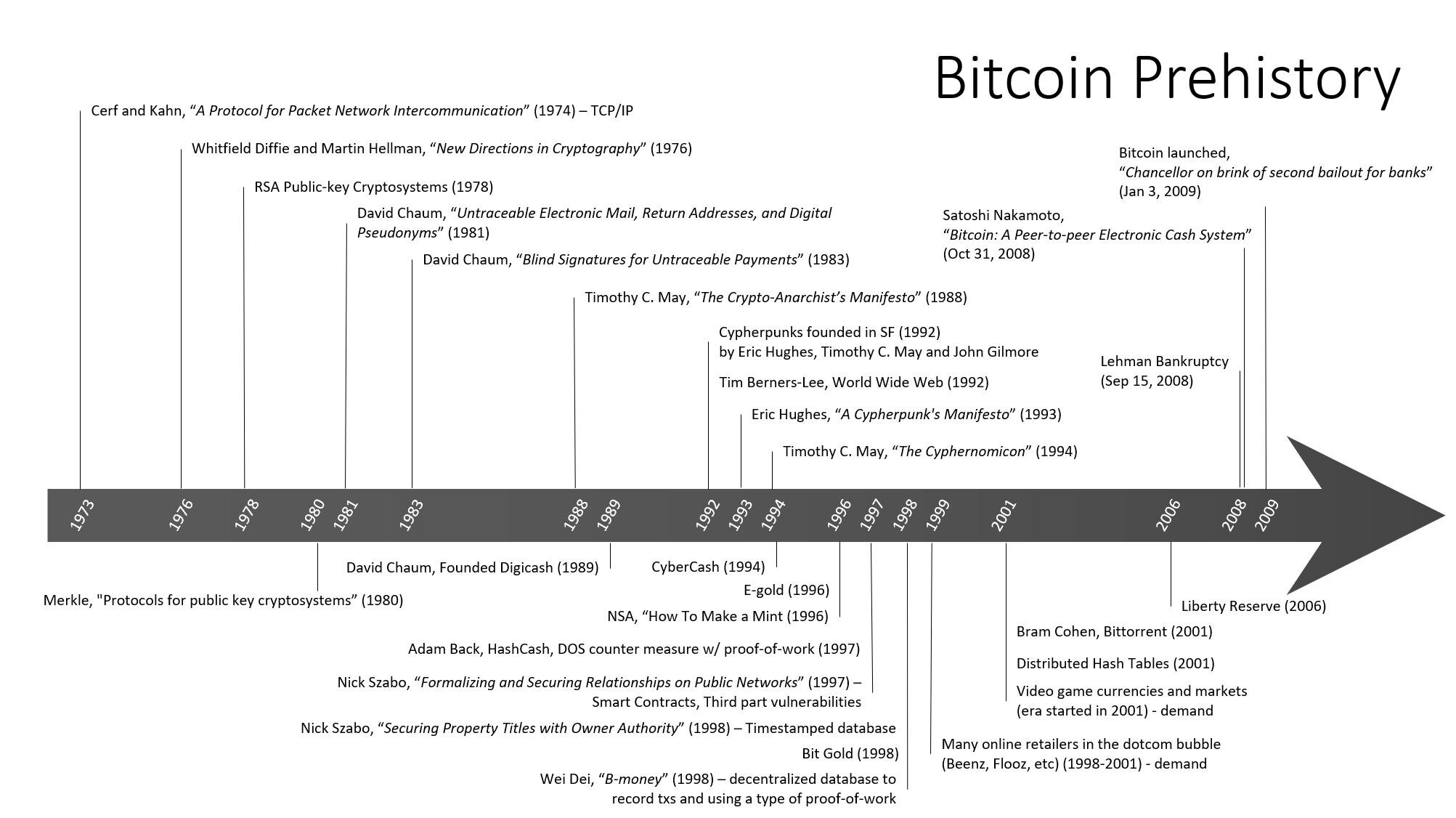

These two moments in time: 1992 and 2017 are quite comparable when viewed with a proper understanding of where decentralized open ledger platform technology is going. Consider further that if the first web browser signaled a shift toward making the internet accessible and usable for a wider audience of early adopters, it could not have been introduced without an earlier launch of the world wide web itself in 1989 and the first IBM personal computer, code-named "Acorn," introduced before that in 1981. Bitcoin also has a significant prehistory of innovations without which the 2017 frenzy could never have been possible.

2 [8]/8 = Moon

I have identified the two 16-year periods of 1984-2000 and 2009 – 2025 as the Hype cycles of the initial internet revolution and the next phase after maturity that is currently underway, respectively. In both periods, the most exciting (and profitable) investing years occur in the later eight years after the end of an eight-year initial R&D phase. The later investment period is when start-up companies offer usable products and services to a wider audience of early adopters, continues with supplier proliferation and concludes with activity beyond early adopters.

Why does 1984 equate to 2009 and the launch of the Bitcoin network? Well, just watch the commercial below and see if the parallels become clearer…

"1984" is an American television commercial which introduced the Apple Macintosh personal computer. Its only U.S. daytime televised broadcast was on January 22, 1984 during and as part of the telecast of the third quarter of Super Bowl XVIII.

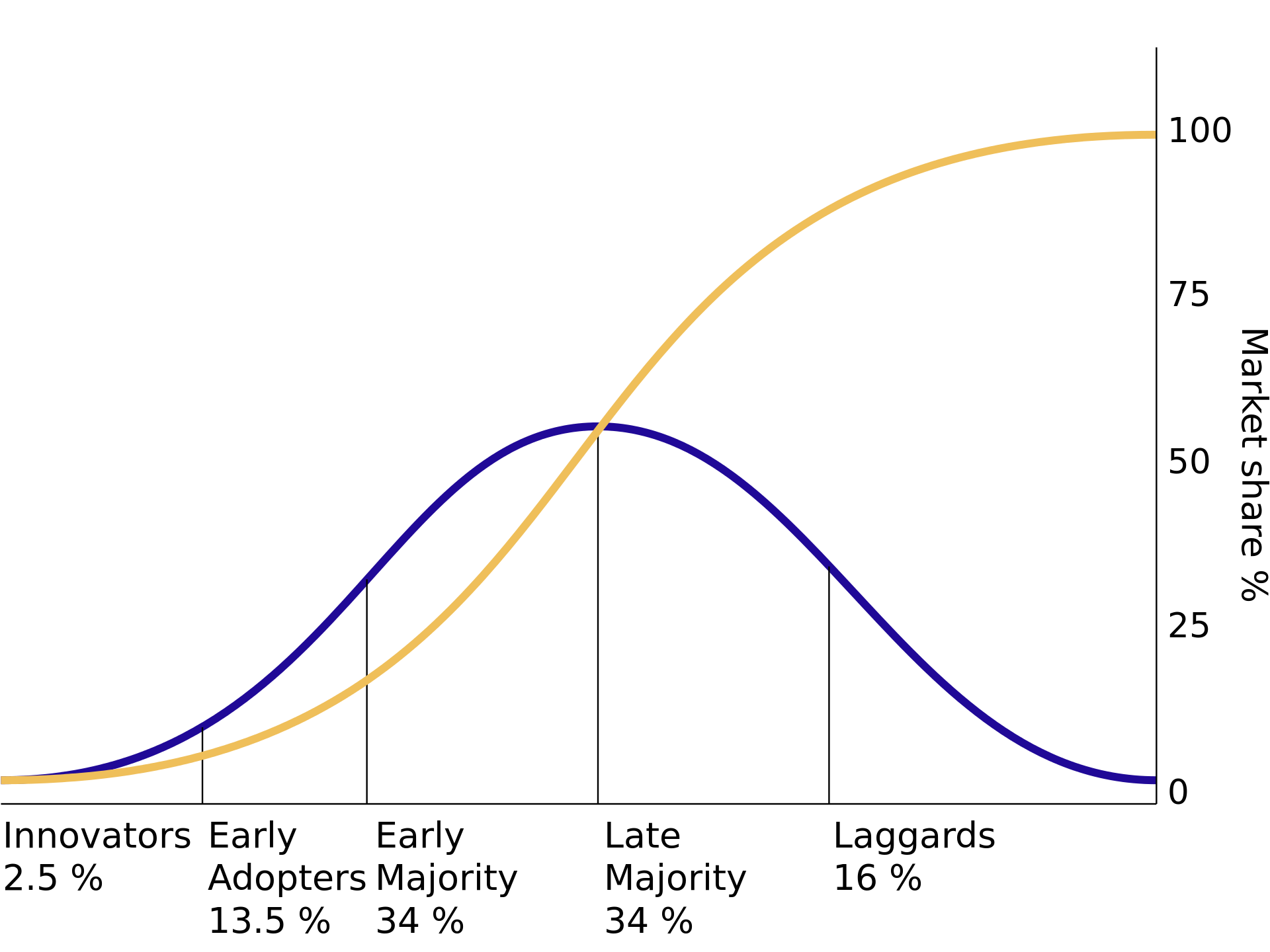

Note that the 2017 Initial Coin Offering craze was NOT comprised of early adopters, but reflected extreme exuberance among early investors and speculators rather than users. The overwhelming majority of ICOs raised funds for products and services that had not yet been built and were not available for use. The offerings were still in the research and development phase. The people who have been involved with digital assets and cryptocurrencies prior to 2020 are not the early adopters – they are the Innovators.[5]

The diffusion of innovations according to Everett Rogers. With successive groups of consumers adopting the new technology (shown in blue), its market share (yellow) will eventually reach the saturation level. The blue curve is broken into sections of adopters.

In 2020, hardly anyone actually uses distributed ledger technology other than for investment, speculation and R&D. This will change, and rapidly, in 2021 and none other than the Federal Reserve System of the United States itself may be the catalyst with a new blockchain-based digital dollar.

BOSTON HERALD: Boston Fed Bank explores cryptocurrency with MIT

FORBES: Digital Dollar And Digital Wallet Bill Surfaces In The U.S. Senate

INFINITY AND BEYOND

Web 3.0 has been in its current R&D “Technology Trigger” phase since the January 2009 launch of the Bitcoin network and this phase includes all the activity happening in the digital asset sector since then until now. The number of players, users and capital in the space in 2020 is like a few grains of sand compared to an entire beach frontage that will be revealed after the Great Reset – a tsunami of wealth transferring from our current paper asset, U.S. Dollar based global fiat system to one based on a new digital world currency.

Will the next reserve asset for the world be Bitcoin, or priced in bitcoin? Will it be the new Federal Reserve Digital Dollar? Will it be Facebook’s Libra or some other reference asset backed by gold or a basket of new national currencies?

While the question of which asset will be crowned king may not have a clear answer, the events of 2020 point to a natively digital asset of some kind as the only way forward. By 2025 the digital reality that will shape the next 100 years should be firmly in view, and the identity of the Next Seven Sisters confirmed.

[1] The Fourth Industrial Revolution (or Industry 4.0) is the ongoing automation of traditional manufacturing and industrial practices, using modern smart technology. Large-scale machine-to-machine communication (M2M) and the internet of things (IoT) are integrated for increased automation, improved communication and self-monitoring, and production of smart machines that can analyze and diagnose issues without the need for human intervention.

Prior to the Fourth Industrial Revolution

The First Industrial Revolution was marked by a transition from hand production methods to machines through the use of steam power and water power. The implementation of new technologies took a long time, so the period which this refers to it is between 1760 and 1820, or 1840 in Europe and the United States. Its effects had consequences on textile manufacturing, which was first to adopt such changes, as well as iron industry, agriculture, and mining although it also had societal effects with an ever stronger middle class. It also had an effect on British industry at the time.

The Second Industrial Revolution, also known as the Technological Revolution, is the period between 1871 and 1914 that resulted from installations of extensive railroad and telegraph networks, which allowed for faster transfer of people and ideas, as well as electricity. Increasing electrification allowed for factories to develop the modern production line. It was a period of great economic growth, with an increase in productivity, which also caused a surge in unemployment since many factory workers were replaced by machines.

The Third Industrial Revolution, also known as the Digital Revolution, occurred in the late 20th century, after the end of the two world wars, resulting from a slowdown with industrialization and technological advancement compared to previous periods. The global financial crisis in 1929, followed by the Great Depression, affected many industrialized countries, following the first two revolutions. The production of the Z1 computer was the beginning of more advanced digital developments. This continued with the next significant progress in the development of communication technologies with the supercomputer. In this process, where there was extensive use of computer and communication technologies in the production process. Machinery began to abrogate the need for human power.

Source: Wikipedia

[2] "Seven Sisters" was a common term for the seven transnational oil companies of the "Consortium for Iran" oligopoly or cartel, which dominated the global petroleum industry from the mid-1940s to the mid-1970s. Alluding to the seven mythological Pleiades sisters fathered by the titan Atlas, the business usage was popularized in the 1950s by businessman Enrico Mattei, then-head of the Italian state oil company Eni. The industry group consisted of:[1][2][3]

· Anglo-Iranian Oil Company (originally Anglo-Persian; now BP)

· Standard Oil Company of California (SoCal, later Chevron)

· Gulf Oil (now merged into Chevron)

· Texaco (now merged into Chevron)

· Standard Oil Company of New Jersey (Esso, later Exxon, now part of ExxonMobil)

· Standard Oil Company of New York (Socony, later Mobil, now part of ExxonMobil)

Preceding the 1973 oil crisis, the Seven Sisters controlled around 85 per cent of the world's petroleum reserves.[4]

Source: Wikipedia

[3] March 9, 1992 – ViolaWWW, the first popular Web browser, created by Pei-Yuan Wei in the United States, is publicly released for Unix.

Source: Wikipedia

[4] March 12, 1989 - Tim Berners-Lee submits a memorandum, titled "Information Management: A Proposal", to the management at CERN for a system that would eventually become the World Wide Web.

Source: Wikipedia

[5] Diffusion of innovations is a theory that seeks to explain how, why, and at what rate new ideas and technology spread. Everett Rogers, a professor of communication studies, popularized the theory in his book Diffusion of Innovations; the book was first published in 1962, and is now in its fifth edition (2003).[1] Rogers argues that diffusion is the process by which an innovation is communicated over time among the participants in a social system. The origins of the diffusion of innovations theory are varied and span multiple disciplines.

Rogers proposes that four main elements influence the spread of a new idea: the innovation itself, communication channels, time, and a social system. This process relies heavily on human capital. The innovation must be widely adopted in order to self-sustain. Within the rate of adoption, there is a point at which an innovation reaches critical mass.

The categories of adopters are innovators, early adopters, early majority, late majority, and laggards.[2] Diffusion manifests itself in different ways and is highly subject to the type of adopters and innovation-decision process. The criterion for the adopter categorization is innovativeness, defined as the degree to which an individual adopts a new idea.

Source: Wikipedia

NOTICE & DISCLAIMER:

All #fhomoney content here and elsewhere is for educational and entertainment purposes only. I do not guarantee the accuracy of any information posted, linked to or shared. Pretty please (with sugar on top), D.Y.O.R. - DO YOUR OWN RESEARCH. As a nascent technology and emerging asset class, investments in digital assets and cryptocurrencies are extremely RISKY and VOLATILE.

I do not accept sponsors, advertising or compensation of any kind for what I share or discuss.

Nothing I post here or on any other channel is investment advice, a solicitation for any investment or legal advice. I am not your investment advisor or your attorney unless you have retained me pursuant to appropriate conversations and signed client agreements.

©2020 Kianga Daverington | Future History of Money